You’re getting a divorce and it’s time to figure out major questions like, What happens to the house in a divorce? Who gets the house in a divorce? Should I keep the house? Do I have to refinance after divorce? What is a divorce house buyout and how does it work?

Let’s explore these questions in more depth.

Who Gets the House in Divorce and What Happens

- Why It’s So Difficult to Decide What to Do with the House in Divorce

- Who Gets the House in Divorce, Legally Speaking

- Do I have to Refinance after Divorce? List of Options for Home in Divorce

- Due Diligence: Factors to Consider If You Want to Keep the House

- Make Sure You Qualify for a Mortgage in Divorce

Skip the article and download the Ultimate Guide: What Happens to the House in Divorce

1. Why It’s So Difficult to Know What to Do with the House in Divorce

The house is often considered the trickiest of all assets in a divorce. On Day One as you approach divorce, you may be thinking, “My house is one of my biggest assets.” or “Maybe I want to keep it.” “What you really need to understand is that there’s a lot of due diligence to be done before making a decision on what to do with the house,” says Marilee Wolf, realtor at BHHS Fox & Roach and Real Estate Collaboration Specialist for Divorce.

The hardest part is that there are many emotional and financial events that happen during a divorce. You might also tend to think, “I know my home. It’s the only consistent element to this whole disruptive process of divorce.” That’s why you might be inclined to want to stay or keep the house.

Let’s look at 4 major reasons why it’s so difficult to know what to do with the house in divorce:

1) You are Distracted

- Financial dilemmas layered on top of divorce are incredibly overwhelming and stressful. You are likely trying to maintain your current lifestyle, taking kids to sports, working or looking for a job. There are many things happening at once.

2) Your House is a Symbol of Stability (and maybe even status)

- The house itself might come to symbolize some stability and consistency, especially for kids. They don’t want to change schools. It’s a safe-haven during times of disruption.

- Your home represents “happily ever after” and “the American dream.”

3) Hard to Know Whether You Can Afford to Keep the House

- Change is constant. House conditions, the economy, and job security may change; all affecting whether or not the house upkeep, taxes, bills, and mortgage are affordable.

- Real estate values are fluid. Let’s say that you decide to keep the house, and the value is determined to be $100,000. Then, something happens to the economy, or an interstate goes up in the backyard, or something happens to that value down the road. Can you withstand that?

“Just because you can get a mortgage for something doesn’t mean you can afford it,” says Jeff Weaver, Senior Mortgage Planner at American Residential Lending.

4) Sentimental Value

- Your home feels priceless. Dissolving the marriage is emotional. You have poured your heart and soul into creating a loving home environment for your family. You have memories that are priceless and that clouds your ability to make rational decisions.

“Most people think of their homes in regards to the memories attached to it. You don’t have memories attached to your 401K,” says Jeff.

2. Who Gets the House in Divorce

Often times one spouse will express an interest in staying in the home after the divorce. “Usually but not always it is for the main reason of keeping the children stable after the divorce for a period of time, and to get them through the transition,” says Cris Pastore, attorney-mediator and co-founder of Main Line Family Law Center.

Do I ever have to sell my house (for legal reasons) in a divorce?

When it comes to who gets the house in divorce, “A court can order in the interim who stays or who goes, but what if a couple is in the house, and you are not sure what to do with it, and the house then could become a financial burden to one or both of you,” says Cris.

If neither spouse can afford to live there, or if it is deemed not prudent for them to be there, then it's not sensible for the children to be in that home. And because they cannot be supported adequately in that home, then a court may order the selling of the house and division of the proceeds.

Legally speaking, “It is not that one gets the house versus the other, but what are we doing with the house, what is the most sensible financial plan around the house in the divorce,” says Cris Pastore, attorney-mediator.

What happens when the wife's or husband's name is not on the deed to the house in a divorce situation?

“If a spouse is awarded the house in the settlement agreement and they are currently not on title then they would be a ‘successor-in-interest,’ says Jeff. “In other words, they are able to claim the title to the property via the signed marital settlement agreement. So they can do a mortgage refinance for divorce, but it would be a cash-out refinance because they aren’t on title. So they are limited to a mortgage amount of 85% of the value. They would have had to be on title for 12 months to do a rate and term refinance.”

3. Do I Have to Refinance After Divorce? List of Options for Your Home in Divorce

Option 1: "THE CLEAN BREAK" Sell the House

Your first option is to sell the house and convert that into cash. “It’s the least risky thing to do because you sever all of that joint liability and debt with your ex-spouse. Selling the house is the cleanest way to pull out your financial assets,” says Marilee.

Option 2: Refinance House After Divorce:

In this option, one keeps the house and takes on all the bills, the other gets a clean break.

“Affordability is the key here,” says Cris. There are of course costs to refinancing a home after divorce, closing costs, etc. which are mostly rolled into the mortgage, and an appraisal of the house will be necessary as well.

Two major goals here is to first do this refinance so the mortgage doesn’t skyrocket for the spouse staying in the home and buying the other one out, and to make sure that the house spouse qualifies to be on the mortgage alone.

A divorce house buyout is an issue that can be resolved in divorce mediation, as long as the spouses are amicable enough.

Option 3: HAPPY MEDIUM? One of You Buys Out the Other

An in-between option is doing a buyout, where one spouse makes a deal to buy the house from the other. It may include a transfer of equity to the other spouse. This option can be riskier than selling the house because there are home value and condition issues to consider.

“One scenario that has become more popular lately is a hybrid. At the time of the divorce, spouses will agree to continue to own the house for a period of time after the divorce, and they generally remain on the mortgage and the deed until the home is sold, or maybe a buyout occurs,” says Cris.

Option 4: LAY LOW - Do Nothing

The other end of the spectrum is to do nothing, just to leave the house, mortgage, and joint title as it is. “That’s the riskiest because at the end of the day you end up being legally divorced, but financially you’re still married to each other,” comments Jeff. That partnership can be difficult, depending upon how amicable your divorce is.

Doing this keeps the parties tied together to their biggest financial holding.

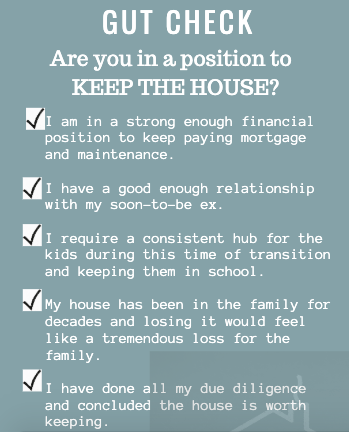

4. Due Diligence: Part 1

Factors to Consider When Deciding What to Do with the House

“The biggest thing when you’re starting to consider what to do with the house in a divorce is to view your house as, “Okay, I’m going to buy this house all over again.” and “What am I actually getting if I’m going to keep it?” says Jeff.

Do Your Due Diligence: Part 2

Determine the True Value of Your House in Divorce

What Goes Into House Valuation?

"Treat determining the value of your house with the same due diligence that you did when you first bought it! In addition to an appraisal, it is critical to look at the condition of your property, title and home owner's insurance," says Marilee Wolf, Real Estate Collaboration Specialist-Divorce.

Home value is an extremely fluid thing. For any given day, for any house, one could determine a dollar figure. As the housing market and the economy change, those values might also change.

Consider these 4 value factors:

- Home Value/Condition - Think as if the house is being purchased all over again, which is basically what’s happening if you are planning to keep the house.

- Appraisal - an evaluation done by a licensed professional, called an appraiser, which is used to determine future loan performance, and provides an estimated value of your home.

- Equity - the appraised value minus the amount still owed on the mortgage or the mortgage payoff. Equity is an important part of the equation for determining what you will receive when you sell your house.

- Fair market value - the amount of money that a home buyer would be willing to pay for the house on the open market. This fair market value may or may not match up with the appraised value. Look at Trulia.com or Zillow.com or MyRealEstateValues.com for estimates or ask your Realtor for a free evaluation.

What Tends to Get Overlooked in Divorce

Hmmm..I heard I just needed a home appraisal, right? Not exactly. Home condition matters, too.

When someone says, “well, I had my house appraised two years ago,” that is not meaningful. All of the above variables fluctuate, so an appraisal is only relevant for 3 to 6 months.

Look Under The Hood

Appraisal and fair market value take cosmetic and physical defects into consideration. But there is also what’s happening in the infrastructure - or the stuff that can’t be seen or determined without hiring an expert to investigate. There could be larger defects or issues, like needing a new roof, stucco problems, a failed septic system, or an old heater that affect the value of your house.

When you originally bought your house, you might have had several consultations and inspections to inform you about what you’re buying. Insurance companies may have sent someone to the house to do a walkthrough. The bank did a title search to make sure there were no liens on the property and also ordered an appraisal to make sure you knew what you were getting.

In a divorce, however, these checks don’t commonly occur.

“In divorce, you are negotiating a lot of things at once. But a house is not like a savings account. Your pension doesn’t have a leaky roof or a stucco problem.”

~ Jeff Weaver, Senior Mortgage Specialist

What could easily happen with determining home value in divorce is that your attorney might say, Okay, what’s your mortgage balance statement? Okay, I see it’s $200,000. Great. Let’s get an appraisal to see what the value is, then subtract what you owe out of that and this will tell you what your proceeds will be when you sell.

They may (or may not) get a realtor to give their opinion of market value. And, you will most likely not be advised to get your house inspected, to look at your title for judgments and liens and to make sure your insurance is in good standing. Appraisal minus equity equals a very incomplete picture of the house as an asset.

Keeping the House: Financial Problems that Arise

Some couples have an arrangement where one spouse stays and the other has left, but the mortgage and the deed still have both names. While it could work out, it is very risky depending on the parties involved.

Lien and Judgments

- What happens if one of the parties stops paying federal taxes, or racks up a large credit card bill that goes to judgment? Those could become liens on the house. “Liens and judgments follow the property, not the person,” says Marilee. If a lien gets put on the house, and then, later on, the spouse who stayed decides to take it on by him or herself and doesn’t know that that’s there, it could potentially be very problematic.

Foreclosure

- What if one party stops paying his or her part of the mortgage? Foreclosure proceedings might begin. The spouse who did hold up his or her end of the payment could now be facing the situation of the lender taking possession of a mortgaged property if the owner can’t pay the outstanding debt, and ultimately the home could go to foreclosure.

Deferred Maintenance

You could live in a house for decades and be unaware of big-ticket things that are going on in the house. “I hear it all the time when I’m selling houses,” says Marilee. “For example ‘we had no clue it was all knob and tube electric,” or ‘we’ve been using that septic system and it was fine.”

If you have an old house with a large amount of deferred maintenance and no savings, you could end up paying tens of thousands of dollars for repairs and mandatory updates, which could really hurt you financially.

Keeping both names on the mortgage and the deed is a risky option. But, if that’s the only option available to a couple, then you should get a legal professional to draft up the language in a property agreement that protects the person who is staying in the house.

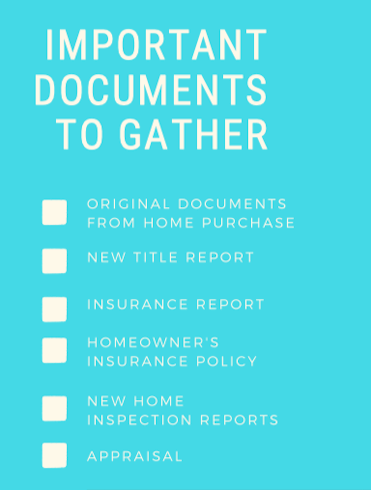

Keeping the House in Divorce: Important Documents to Gather

If you are the one wanting to keep the house, obtain:

- Original documents from when you purchased the house to confirm what was signed. If you don’t have them, ask your realtor.

- Documentation about the current house condition, including:

When Considering a Buyout Deal

Get an appraisal. Ask your mortgage company what your current payoff looks like and then do your due diligence around house and title condition. Subtract out from the appraised value what is still on the mortgage; then subtract out any big-ticket repairs and say, “If I’m going to buy you out, I’ll give you half, or X%, of this amount,” says Marilee. She adds that if there is a judgment or lien on the house, this should also be factored into that final number.

-----------

Think Past and Future

Checklist of Questions to Ask

- Are there any liens or judgments that are hurting the condition of the title?

- Has the homeowner’s insurance been kept up to date?

- Have a high number of claims been made?

- Is there going to be a problem down the road with the insurability of the house?

- What am I actually qualified for in terms of a mortgage?

- What can I afford realistically?

- What is the true equity of my house?

- Is my house really an asset or a liability?

- What is that asset? What is the true value of that asset?

- What kind of repairs need to be done right now?

- Will major repairs be needed in the future?

- Could we create memories in a new place just as well? Is home really where the heart is?

- How much time and expense will it cost to move?

5. Make Sure You Qualify for a Mortgage in Divorce

Aside from already talking to your legal team, mediators, and lawyers as part of your divorce, it is critical to talk to a mortgage professional as soon as possible, ideally, one who is specially trained to be able to serve this particular type of homeowner. “You don’t want to wait,” says Jeff.

Before you start negotiating assets as part of your marital settlement agreement you’ll want to know exactly what you can afford to do.

Credit and Income for Qualifying for Mortgage in Divorce

For example, if you’re going to refinance the house after divorce and you’re going to give $50,000 of home equity to your spouse, you’ll first need to know whether you can actually qualify to do that.

In addition to getting a copy of your credit score, you’ll want to have ideally at least 2 years of documented income from the same company or industry to qualify.

“Many people figure that if they have good credit and good income it will not be a problem to refinance. They sign their marital settlement agreement, and then they have 90 days to refinance,” says Jeff. “Then they go to refinance and they realize, “Wait. There’s something I didn’t take into consideration. Now I have an issue. I can’t do $50,000. I can only do $40,000.” Then you’ve got to go back to court and back to your lawyer or mediator, which costs money and takes time to go back and renegotiate what you’ve already negotiated.

Alimony and Child Support as Qualifying Sources of Income for Mortgage

If you are receiving some kind of support, you really want to find out what you qualify for in terms of a mortgage. Just because you’re receiving support doesn’t mean it’s qualified income for a mortgage, as it has to meet certain standards.

“Alimony and child support has to be stable and ongoing. You have to be receiving it for six months and continue for three years. You want to make sure that you can do whatever you’re agreeing to do, so it’s important to understand that as early on in the process as possible,” says Jeff.

Ideally, you should be going into your negotiations with your attorney or mediator already having had an appraisal and title search done, and having your credit checked.

“Know that you can get this amount of equity if you have to, and have a plan on how to do it. That’s going to save you time and money in the long run; so as early as possible, start thinking about these things, especially if you’re keeping the house,” Jeff explains.

Work with a Mortgage Professional Who Knows Divorce

You really need to work with somebody who understands mortgage divorce guidelines for mortgages. There are specific guidelines for qualifying for a mortgage in divorce. “A lot of my clients will come to me because they went to their bank and said, “Hey, I’m getting a divorce. I need $50,000 cash out,” and the bank says, “No, you can’t do that.” They actually could do that if the loan officer understood the divorce guidelines for a mortgage,” says Jeff.

It’s really incumbent upon such people to find somebody who understands specific divorce guidelines to know what they can actually do, and do it in the most efficient, cost-effective way possible. If the lender or bank loan officer doesn’t know what those are, it can be very frustrating.

All in all, divorcing your house is a big step and hopefully, you are now one big step closer to knowing what to do next with your house.

About the Author

Sharon Pastore, Main Line Family Law Center

Sharon Pastore is Co-Founder of Main Line Family Law Center, which was established in 2012. She is on a mission to generate awareness, understanding and trust around mediation as a healthier option for separation and divorce well before a client's first consultation. She draws upon over 17 years in nonprofit, education and marketing to enable more spouses to "get to the table" and mediate successfully.

Sharon Pastore is Co-Founder of Main Line Family Law Center, which was established in 2012. She is on a mission to generate awareness, understanding and trust around mediation as a healthier option for separation and divorce well before a client's first consultation. She draws upon over 17 years in nonprofit, education and marketing to enable more spouses to "get to the table" and mediate successfully.

Topics: Get into Financial Shape